Télécharger le fichier original (Mémoire de fin d’études)

General Introduction

The aim of this thesis is to evaluate the conduct of macroprudential policies in an heterogeneous monetary union, such as the Eurozone, by borrowing on the recent theo-retical and empirical developments of Dynamic Stochastic General Equilibrium (DSGE) models.

This introduction brie y sketches the main building blocks of this thesis. Section 1 quickly summarizes the consequences of the recent nancial crisis on the conduct of economic policy in developed economies, by insisting more particularly on the intro-duction of macroprudential concerns. Section 2 outlines some useful recent theoretical and econometric progresses made by DSGE models to account for nancial factors in the determination of economic equilibrium and to provide the basis for the modeling of macroprudential policies. Section 3 presents some main Eurozone economic and insti-tutional speci cities that we consider to be important in the building of our analytical framework. Section 4 provides a survey of the main contributions of the thesis to the existing literature. Section 5 describes the structure of the thesis, organized in 5 chap-ters.

1 Towards a New Normality in Economic Policy

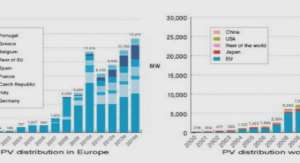

Over the two decades preceding the subprime crisis of 2007, a widespread consensus identi ed low and stable in ation as the primary mandate of monetary policy to pro-vide macroeconomic stability. The general agreement among macroeconomists was that the decline in the variability of output and in ation (« the great moderation ») observed in the data could be linked to a coherent policy framework based upon the conduct of monetary policy using an interest rate aimed at stabilizing in ation. Controlling in a-tion would in turn limit the output gap. In the meanwhile, mainstream macroeconomics had taken a benign view on nancial factors in amplifying output and employment uc-tuations. In this policy environment, the stability of the nancial system was achieved through microprudential regulation insuring the soundness and safety of individual – nancial institutions.Ignoring the macroeconomic implications of nancial imbalances that a ected the Eu-rozone (Figure 1) proved to be extremely costly. The consequences of the US sub-prime crisis of 2007 and the accompanying dramatic fall in output (Figure 2) and rise in unemployment exposed the limitations of the economic framework that was successful in providing macroeconomic stability during the « great moderation » period.

(a) Corporate Loans (b) Real Estate Loans (c) Interbank Loans

Figure 2: GDP Loss after the nancial crisis episode in the Eurozone and the US (Sources FRED).

The nancial crisis has accelerated the introduction of a new policy domain called macro-prudential policy in developed countries, inspired by the early contributions of Crockett (2000). This episode has highlighted the need to go beyond a purely microeconomic approach to nancial regulation and supervision. It has broken a general agreement limiting nancial supervision at the microeconomic level, while a new consensus has emerged, considering that prudential measures should also be set at the aggregate level through macroprudential measures to complete monetary policy measures.

As broadly de ned by the International Monetary Fund (IMF), the nal objective of macroprudential policy is to prevent or mitigate systemic risks that arise from develop-ments within the nancial system, taking into account macroeconomic developments, so as to avoid periods of widespread distress. The novel dimension introduced by macro-prudential policy is to promote the stability of the nancial system in a global sense, not just focusing on individual nancial intermediaries. This aggregate approach aims at solving a fallacy of composition in the evaluation of nancial distress. A simple example makes this fallacy easy to understand: it is rational for a bank to sell assets with a decreasing value to mitigate the risk at the individual level. However, generalizing this decision at the aggregate level is not optimal for the economy as a whole since it leads to a higher decrease in the price of this asset, thus amplifying nancial troubles. The de nition of macroprudential measures is necessary to avoid this kind of problem.

Furthermore, as underlined by the IMF, the legislation regarding national macropruden-tial systems should include adequate provisions regarding the objective, the functions and the powers of the macroprudential authorities. Namely, clear objectives with ex-plicit targets should guide the decision-making process and enhance the accountability of authorities. The key macroprudential functions should include the identi cation of systemic risks, the formulation of the appropriate policy response and the implementa-tion of the policy response through adequate rulemaking. Finally, the macroprudential authority should be empowered to issue regulations, collect information, supervise reg-ulated entities and enforce compliance with applicable rules.

Today, there is a main di erence between monetary policy and macroprudential policy. There is a clear-cut consensus on the role of di erent instruments in the conduct of mon-etary policy, as the policy rate is seen as the primary instrument, while non-conventional tools should be used in situations where policy rates are close to the zero bound. In contrast, the literature on macroprudential policy is still far from such a consensus. Two aspects are currently debated on the conduct of macroprudential policy regarding the choice of instruments on the one hand, and the choice of an optimal institutional framework on the other hand.

In a series of papers, the IMF has tried to summarize existing macroprudential practices. Lim (2011) nds that up to 34 types of instruments are used. These instruments aimed at mitigating the building of nancial imbalances can be classi ed along alternative criteria. As proposed by Blanchard et al. (2013), we can distinguish measures that are oriented towards lenders from those focusing on borrowers. Furthermore, a second typology distinguishes cross-sectional measures (i.e., how risk is distributed at a point in time within the nancial system) and tools addressing the time-series dimension of nancial stability (coming from the procyclicality in the nancial system). However in practice, this policy appears to be rather exible, as di erent instruments can be used at the same time, depending on the national situation.

Regarding the way the macroprudential mandate should be implemented, the current debate focuses on the nature of the authority. The main question is to determine whether the macroprudential mandate should be given to an independent authority or whether it should be set by the central bank in line with monetary policy decisions.

The main argument in favor of mixing both monetary and macroprudential policies is the following: to the extent that macroprudential policy reduces systemic risks and creates bu ers, it helps the task of monetary policy in the face of adverse nancial shocks. It can reduce the risk that monetary policy runs into constraints in the face of adverse nancial shocks, such as the zero lower bound. This can help alleviate con icts in the pursuit of monetary policy and reduce the burden on monetary policy to \lean against » adverse nancial developments, thereby creating greater room for the monetary authority to achieve price stability.

The main argument against this organization of the macroprudential mandate lies in the potential con ict of interest, or at least trade-o s, between the two policies. A monetary policy that is too loose may amplify the nancial cycle or, conversely, a macro-prudential policy that is too restrictive may have detrimental e ects on credit provision and hence on monetary policy transmission. Where low policy rates are consistent with low in ation, they may still contribute to excessive credit growth and to the build-up of asset bubbles and induce nancial instability.

As for the choice of the macroprudential instrument, di erent institutional solutions have been adopted in practice: in some cases, they involve a reconsideration of the institutional boundaries between central banks and nancial regulatory agencies (or the creation of dedicated policymaking committees) while in other cases e orts are made to favor the cooperation of authorities within the existing institutional structure (Nier, 2011).

Table des matières

Acknowledgements

Remerciements

Contents

General Introduction

1 Towards a New Normality in Economic Policy

2 The Recent Evolution of DSGE Models

3 European Features

4 Key Contributions of the Thesis

5 Structure of the Thesis

1 An Introduction to Macroprudential Policy

1 Introduction

2 The eect of nancial frictions in the case of a simple monetary policy rule

2.1 A Static New Keynesian Model with a Banking System

2.2 The Consequences of the Procyclicality of the Financial System .

3 Optimal Monetary Policy and the Concern for Financial Stability .

3.1 The Optimal Monetary Policy without a Financial Stability Concern

3.2 The Optimal Monetary Policy with a Financial Stability Concern

4 Macroprudential Policy

4.1 The Nature of Macroprudential Policy

4.2 The Design of Macroprudential Policy

4.2.1 The Nash equilibrium

4.2.2 The cooperative equilibrium

5 Conclusion

2 Cross-border Corporate Loans and International Business Cycles in

Monetary Union

1 Introduction

2 Une union monetaire avec pr^ets transfrontaliers

2.1 Choix d’investissement et

ux bancaires transfrontaliers

2.2 Le reste du modele

2.2.1 Les menages

2.2.2 Les syndicats

2.2.3 Les entreprises

2.2.4 Le producteur de biens capitaux

2.2.5 Le secteur bancaire

2.3 Les autorites

2.4 Equilibre General

3 Estimation des parametres du modele

4 Eets macroeconomiques des pr^ets transfrontaliers

4.1 Les consequences de chocs reel et nancier asymetriques

4.2 La decomposition de la variance

5 Conclusion

3 Macroprudential Policy with Cross-border Corporate Loans: Granu-

larity Matters

1 Introduction

2 Relation to the literature

3 Cross-Border Bank Loans and the Macroprudential Setting

3.1 Entrepreneurs and the Demand for Loans

3.2 The Banking Sector and the Imperfect Pass-Through of Policy Rate

3.2.1 Loan supply decisions

3.2.2 Deposit supply decisions

3.3 Macroprudential Policy

4 The rest of the model

4.1 Households

4.2 Firms

4.3 Monetary Policy

4.4 Capital Suppliers

4.5 Governments

4.6 Aggregation and Market Equilibrium

4.6.1 Goods Market

4.6.2 Loan Market

4.6.3 Deposit Market

5 Estimation

5.1 Data

5.2 Calibration and Priors

5.3 Posteriors and Fit of the model

6.1 The Welfare Performance of Alternative Macroprudential Schemes

The Welfare Performance of Alternative Macroprudential Schemes

The Welfare Performance of Alternative Macroprudential Schemes

6 The Ranking of Alternative Macroprudential Schemes

The Welfare Performance of Alternative Macroprudential Schemes

6.2 Macroeconomic Performances

6.3 The critical role of cross-border loans

7 The Impact of Macroprudential Policies: a counterfactual analysis

7.1 The preventive impact of a macroprudential policy

7.2 The curative impact of a macroprudential policy

8 Conclusion

4 Cross-border Interbank Loans and International Spillovers in a Mon-

etary Union

1 Introduction

2 Stylized Facts and Related Literature

2.1 Cross-border lending in the Eurozone

2.2 A quick summary of the related literature

3 A Monetary Union with Cross-border Loans

3.1 An Heterogenous Banking System

3.1.1 Illiquid Banks

3.1.2 Liquid Banks

3.2 Entrepreneurs and Corporate loans

4 The Rest of the Model

4.1 Households

4.2 Labor Unions

4.3 Firms

4.4 Capital Suppliers

4.5 Authorities

4.6 Equilibrium conditions

5 Estimation

5.1 Data

5.2 Calibration and Prior Distribution of Parameters

5.3 Posterior Estimates

6 The Consequences of Cross-border Loans

6.1 A Positive Shock on Total Factor Productivity

6.2 A Negative Shock on Firms Net Worth

6.3 A Positive Shock on Bank Resources

7 The Driving Forces of Business and Credit Cycles

7.1 The Historical Variance Decomposition

7.2 Understanding the Time Path of the Current Account

7.3 Counterfactual Analysis

8 Conclusion

5 Combining National Macroprudential Measures with Cross-border In-

terbank Loans in a Monetary Union

1 Introduction

2 The Institutional Background

2.1 The Federal Organization of Macroprudential Policy

2.2 The granular implementation of macroprudential measures

3 The Analytical Framework

Households

Firms

Entrepreneurs

Banks

Capital Suppliers

Monetary Policy

Shocks and Equilibrium Conditions

4 Estimation and Empirical Performance

4.1 Data

4.2 Calibration and Priors

4.3 Posteriors and Fit of the model

5 Macroprudential Policy

5.1 Countercyclical Capital Buers

5.2 Loan-to-Income Ratio

6 The setting of instruments

6.1 Setting individual instruments

6.2 Combining multiple instruments

6.3 Macroeconomic performances

7 Sensitivity Analysis

8 Conclusion

General Conclusion

A The Non-Linear Model Derivations

1 The Non-Linear Model

1.1 The households utility maximization problem

1.2 Labor Unions

1.3 The Final Goods Sector

1.4 The Intermediate Goods Sector

1.5 Entrepreneurs

1.5.1 The Balance Sheet

1.5.2 The Distribution of Risky Investment Projects .

1.5.3 Prot Maximization and the Financial Accelerator

1.6 Capital Goods Producers

1.6.1 Capital Supply Decisions

1.6.2 The Rentability of one Unit of Capital

1.6.3 Capital Utilization Decisions

1.7 The Banking Sector

1.7.1 The Financial Intermediary (CES Packer)

1.7.2 The Commercial Bank

Illiquid Banks

Liquid Banks

The loan supply decisions

The deposit decisions

1.8 Authorities

1.9 Aggregation and Market Equilibrium

1.9.1 Goods Market

1.9.2 Loan Market

1.9.3 Interbank Market

1.9.4 Deposit Market

2 Denitions for Higher-Order Approximations

2.1 The welfare index

2.2 New Keynesian Phillips curves in a recursive fashion

2.2.1 Sticky Price

2.3 Sticky Wage

2.3.1 Sticky Credit Rate

2.3.2 Sticky Deposit Rate

B The Linear Model

1 Households

2 Unions

3 Firms

4 Entrepreneurs

5 Banks

6 Capital Supply Decisions

7 International Macroeconomics Denitions

8 Monetary Policy

9 Shocks Processes

C Additional Quantitative Results

1 Empirical Performances

2 Driving Forces of Output

3 Robustness Check to the Zero Lower Bound

4 Historical Decomposition of Business and Credit Cycles in the UEM

References

List of Figures

List of Tables

Télécharger le rapport complet