PFMRAF Integration into Project Design

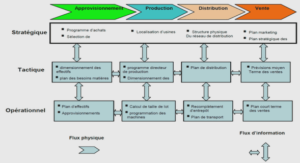

The PFMRAF informs the decision to use partner government systems and is a fundamental component of project design that includes G2G direct assistance. The results of the PFMRAF, primarily the fiduciary risks identified in the Stage 2 Risk Assessment, and the corresponding risk mitigation measures, are integrated into the final project design and included in the project appraisal document (PAD). 4 Chart 4 (G2G Programming Lifecycle) illustrates the integrated relationship between PFMRAF and project design. Both processes are mutually informative and iterative and should guide decision making on all aspects of the final project design. Chart 4 G2G Programming Lifecycle 4 See ADS 201 (Planning) for specifics on the project design process. PFMRAF Integration into Project Design

Risk Mitigation Plan

A risk mitigation plan is required for all projects incorporating G2G direct assistance. It is a component of the Authorization to Use Partner Government Systems (AUPGS), which is required for inclusion in the PAD. The fiduciary risk mitigation plan is informed by the entire PFMRAF process, but primarily by the Stage 2 Risk Assessment. It outlines the project specific fiduciary risks and corresponding mitigation measures to be incorporated in the final project design. Risk mitigation plans must account for all project specific fiduciary risks identified. Non-fiduciary risks and associated risk mitigation plans identified by other means must be also be addressed and included in the PAD. However, the cost-benefit of mitigation should be a consideration in final project design. The more extensive the mitigation plan, the more difficult it may be to work within the confines of the partner government systems. The risk mitigation plan should be specific, realistic and actionable to the project. It should also specify implementation and oversight responsibilities for the mitigation measures accordingly. Mitigation measures that do not address the specific risk are of little value. For example, if a weak information technology process was identified as a risk in a particular area, recommending implementation of a new information technology (IT) system that will take longer to implement than the life of the project would be unrealistic because of the timing and complexity. Risk mitigation plans should be commensurate with the level of risk identified for the specific project. In PFMRAF, the risk score (Critical, High, Medium, or Low) drives the appropriate level of treatment to mitigate the risk. For example, when G2G is undertaken in a “Critical” environment, the risk mitigation plan will be extensive and require substantial supervision. Alternatively, a “Low” risk environment may only require routine monitoring and oversight. It is also important to consider and explain any changes in the risk environment since the completion of the Stage 2 Risk Assessment and those included in the final project design. Mitigation measures may be actions undertaken by the partner government, USAID, other parties, or combinations thereof. While the PGS team should share and negotiate mitigation measures with the partner government implementing entity, the content and sufficiency must represent the independent judgment of the PGS Team and Mission Director. Every project is a unique endeavor. It will be the rare exception that two projects within one country but in different sectors would encounter the same risk profile and require the same mitigation measures. For example, a risk mitigation plan originally developed for the health sector may not be applicable to an education project in the same country. Therefore, risk mitigation plans should be distinct and relevant to the project. In summary, professional and subjective judgment is required to determine the appropriate level of risk mitigation for the project. Table 5 (Illustrative Risk Mitigation Plan) illustrates a typical risk mitigation plan.There are no fixed asset records nor are there efforts to reconcile a physical count of fixed assets to fixes asset records. Lack of proper accounting and verification of fixed assets provides inadequate control over fixed assets. Assets can be easily removed from the district premises without management’s knowledge. Entity prepares a fixed asset registry that contains detailed fixed asset information. Conduct annual inventory of fixed assets and reconcile to the fixed asset registry. 2 2 Med. 1.Prepare fixed asset register with data on all fixed assets; 2. Establish procedures for annual inventory of fixed assets and reconcile to register. Financial Analyst; Technical Officer SemiAnnually

Authorization for Use of Partner Government Systems (AUPGS)

The AUPGS can be considered the capstone document which affirms that the due diligence required for G2G (e.g. PFMRAF) has been completed. It includes the Mission’s fiduciary risk mitigation plan, informed by applicable project design analyses, inputs or outputs to be financed, selection of final methods of implementation and financing, and final judgments with respect to the level of fiduciary risk and related accountability of USAID financing. The AUPGS forms a part of the PAD which is signed by the Mission Director, approving the project and defining terms and conditions applicable to use of partner PFM systems. A single AUPGS may cover more than one project implemented by a single partner government entity, or multiple partner government entities implementing the same project, so long as project and entity specific mitigation measures are clearly identified. Mandatory Components – AUPGS The AUPGS should include the following components: 1. Summary of key findings of PFMRAF 2. Affirmation of PFMRAF completion 3. Final Risk Mitigation Plan 4. Mission Director/Principal Officer concurrence. G2GRMT Review The Risk Mitigation Plan and AUPGS do not require clearance from G2GRMT. However, the G2GRMT is available to review the documents upon request.